does mississippi pay state taxes

If you are receiving a refund PO. You can make electronic payments for all tax types in TAP even if you file a paper return.

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

In addition to low tax rates in general retirees living in Mississippi do not have to pay any state income tax on qualified retirement.

. You can use this service to quickly and securely pay your Mississippi taxes using a credit card debit card or. Forms required to be filed for Mississippi payroll are. Mississippi income tax rate.

Mississippi has a graduated individual income tax with rates ranging from 400 percent to 500 percent. The Mississippi state government collects several types of taxes. The most significant are its income and sales taxes.

The tax rates are as follows. The state offers a homestead exemption for homeowners who are. As of 2019 Mississippi is one of 35 states that offer some type of property tax relief for its senior citizens.

The personal income tax which has a top rate of 5 is slightly lower. On top of that. Resident Joe Bidens plan to forgive up to 10K or 20K of a borrowers federal student loan debt may have tax implications at the state level.

The Mississippi state tax rate is graduated and are the same for individual filers as well as businesses. Box 23050 Jackson MS 39225-3050. Box 23058 Jackson MS 39225-3058.

How does Mississippis tax code compare. But since Mississippi does not require retirees to pay state income tax on qualified income the. The Department of Revenue is the primary agency for collecting tax revenues that support state and local governments in Mississippi.

0 on the first 2000 of taxable income. All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax 7 unless the law exempts the item or provides a reduced rate. Form 89-105 Employers Withholding Tax Return due monthly quarterly seasonal or annual.

Pay by credit card or. Mississippi exempts all forms of retirement income from taxation including Social Security benefits income from an IRA income from a 401k and any pension income. The following is intended to provide general information concerning a frequently asked question about taxes administered by the Mississippi Department of.

Individual Income Tax FAQs. Welcome to The Mississippi Department of Revenue. Mississippi also has a 400 to 500.

Mississippi collects a state income tax at a maximum marginal tax rate of spread across tax brackets. An instructional video is available on TAP. Mississippi is tax-friendly when it comes to retirees.

The state does not tax Social Security benefits income from public or private pensions or withdrawals from retirement accounts. Cre dit Card or E-Check Payments. Unlike the Federal Income Tax Mississippis state income tax does not provide.

Welcome to the online Mississippi Tax QuickPay for Businesses and Individuals. Under the American Rescue Plan Act of 2021. All other income tax returns P.

If you are a nonresident of Mississippi your active duty military income is not taxed in Mississippi. In Mississippi a state sales tax rate of 700 percent is the highest a maximum local sales tax rate of 100 percent is the lowest and a combined state and local sales tax rate. After the first year the tax-free income levels would be 18300 for a single person and 36600 for a married couple lawmakers said.

Harkins said the tax cut would reduce state. Mississippi is very tax-friendly for retirees. You are required to file a Mississippi return and include your active duty pay.

Which States Pay The Most Federal Taxes Moneyrates

Ar Ms Tn Sales Tax Holidays What You Need To Know Localmemphis Com

Tennessee Exempted Taxes On Food Mississippi Exempted Taxes On Guns Mississippi Today

Report Shows Mississippi 7th Highest In State Local Tax Burden Mississippi Politics And News Y All Politics

Report In Mississippi Lower Income Means Higher State And Local Taxes

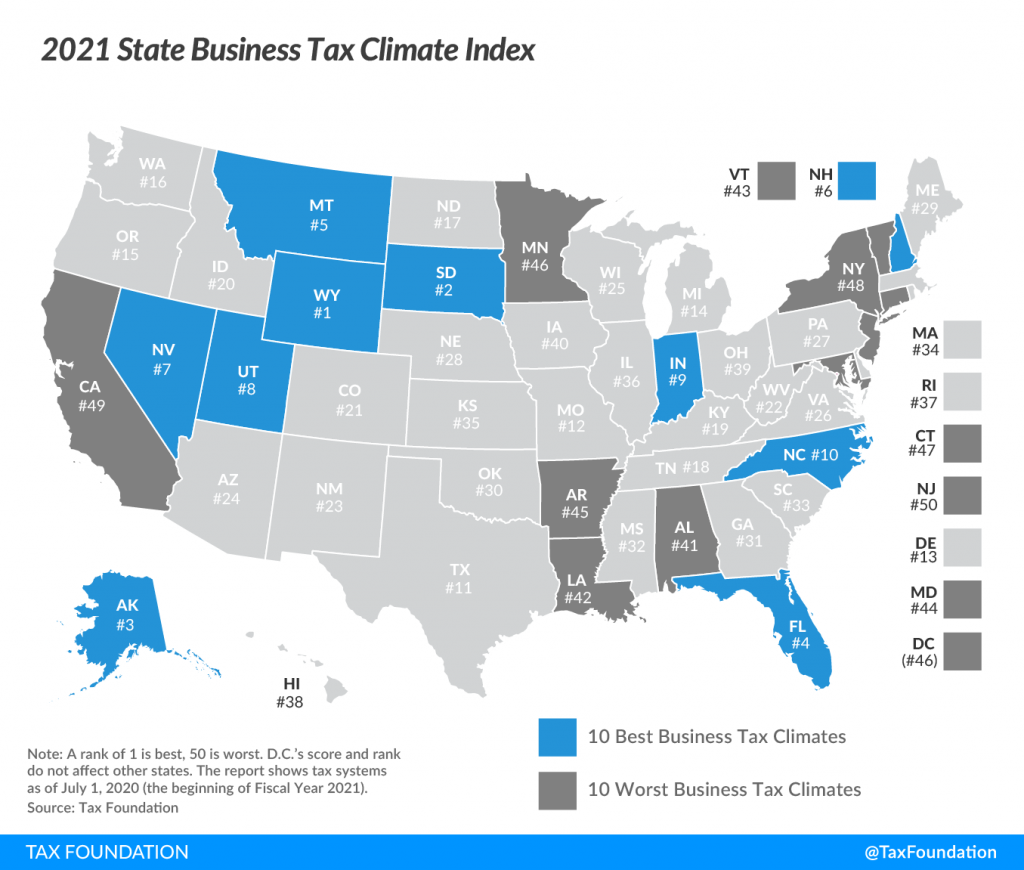

Mississippi S Tax Climate Rated 32nd Best Mississippi Center For Public Policy

Historical Mississippi Tax Policy Information Ballotpedia

Filing Mississippi State Tax Returns Things To Know Credit Karma

Mississippi State Income Tax Ms Tax Calculator Community Tax

Mississippi Income Tax Cut Grocery Tax Reduction

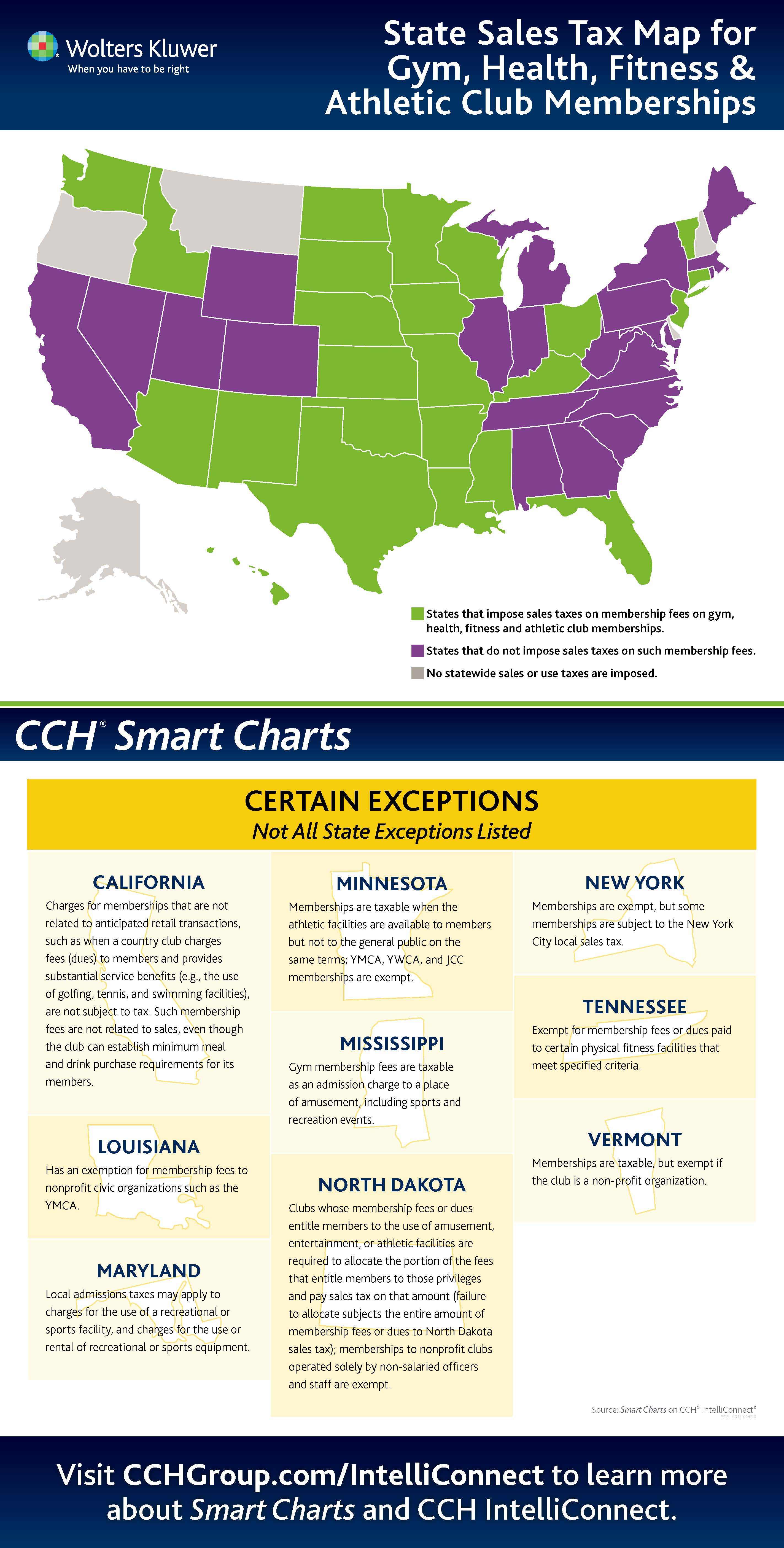

Media Alert Working Out At The Gym Really Can Be Taxing Depending On Where You Live Business Wire

Mississippi Governor Signs State S Largest Income Tax Cut Mississippi S Best Community Newspaper Mississippi S Best Community Newspaper

Prepare Your 2021 2022 Mississippi State Taxes Online Now

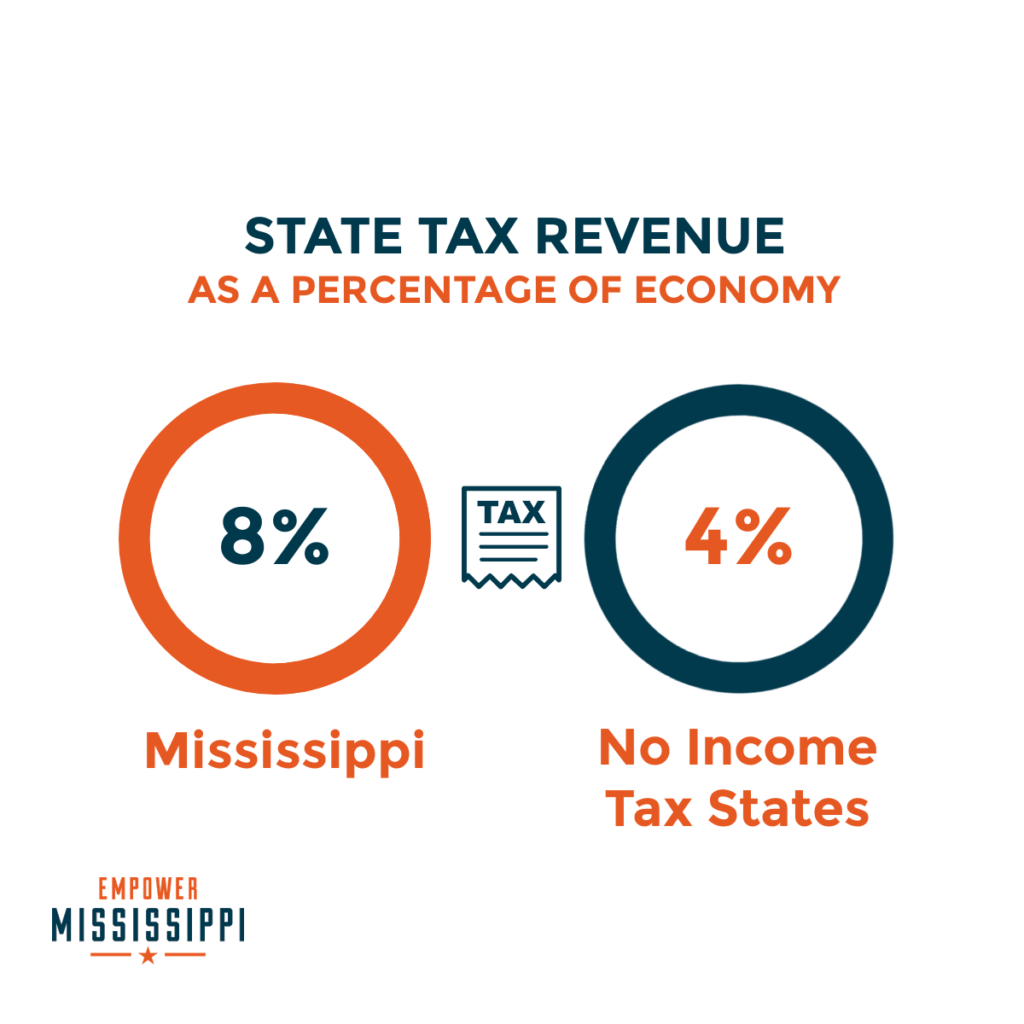

But How Will We Fund Government Without Income Taxes

But How Will We Fund Government Without Income Taxes

Sales Taxes In The United States Wikipedia

Overview Of Options For Taxpayers With Mississippi State Back Taxes

Mississippi Governor Raise Teacher Pay Cut Taxes Localmemphis Com